Market update from our Glasgow and Argyll branches – November 2024

We look at what is happening in the property market locally and nationally with updates from our branches in Shawlands, Cardonald and Dunoon.

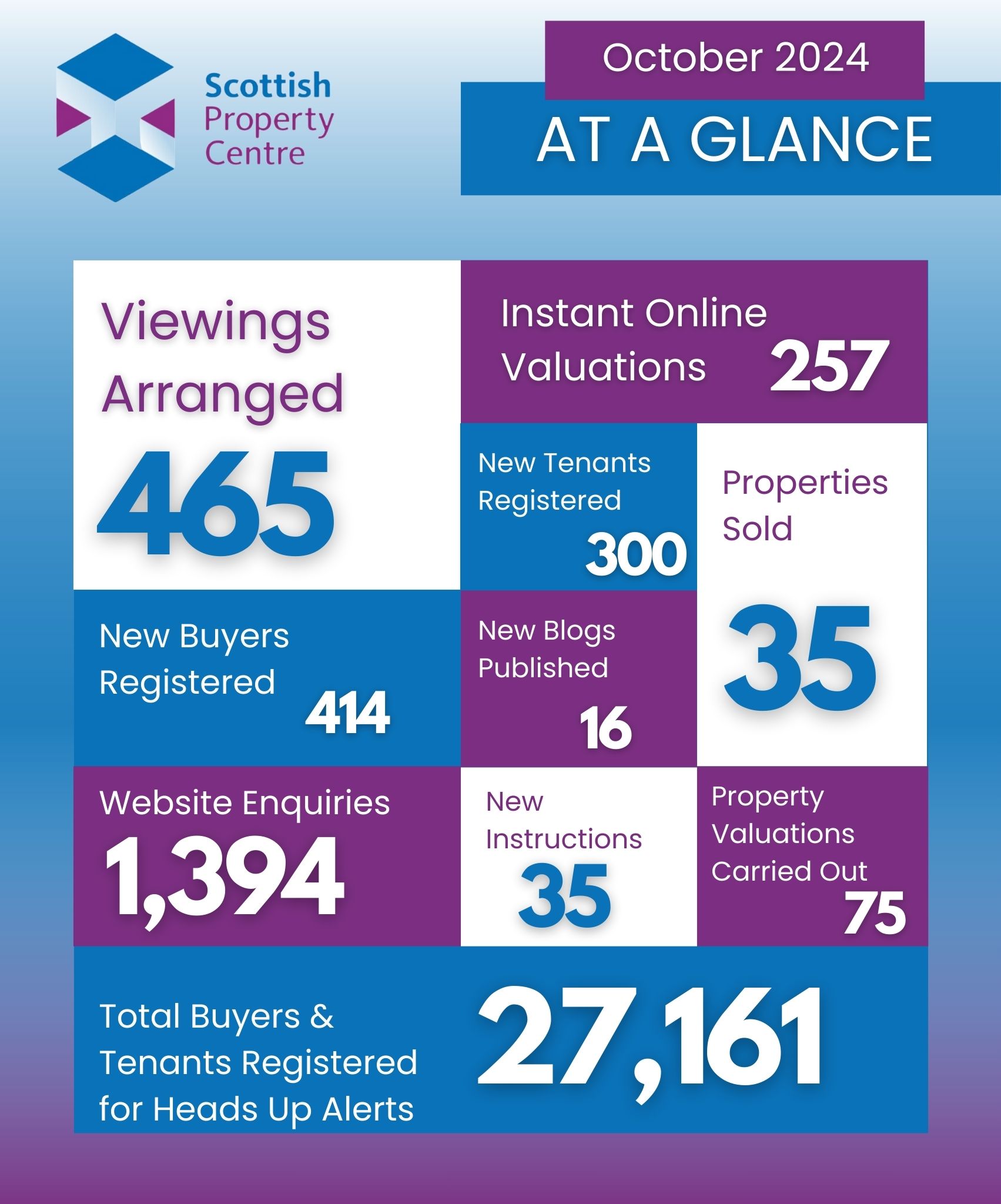

As you can see from the above snapshot of our figures for last month (October 2024) we agreed 35 new sales with 35 new client instructions.

Buyer activity was significantly down across all factors from the previous month with 414 (567 September 2024) new buyers registering for our ‘Heads Up’ property alerts and 1,394 (1,814 September 2024) website enquiries for our owners properties resulted in 465 (553 August 2024) viewings being arranged.

However, despite this drop in buyer activity, we sold more properties during the month than the previous month. This highlights that the buyers that are active in the market at the moment are serious.

Tenant demand was steady with 300 new tenants registered with us during the month, down slightly from 310 in September. This is still significantly lower than the numbers during the first ½ of the year and unlikely to increase now until the new year.

November Outlook

Paul Burns from our Cardonald, Glasgow branch commented – “The market in the Cardonald branch shows no signs of slowing down in November with a record amount of properties being listed throughout the month, with multiple properties still going to closing dates.

The closing dates for the following 4 properties amounted to 54 offers in total, confirming demand continues to outstrip supply.”

Ryless Crescent, Penilee

Mosspark Drive, Cardonald

Sunart Road, Craigton

Corkerhill Road, Mosspark

Liz Dineley from our Dunoon, Argyll branch commented – “This has been our busiest November for sales in the Dunoon and surrounding area since 2020, lots of our lovely sellers and buyers are looking to complete in time for Christmas!

We are looking for more properties to fill the gap left by our recent sales, our agents can discuss listing pre and post-Christmas. Just give us a call on 01369 545 015.

We have 2 recently listed properties that we don’t expect to be around for long, contact us now for more information.”

Back in Glasgow, Craig Smith from the Shawlands branch commented “November has seen a continued drop in new properties coming to the market in Shawlands and surrounding post codes (G41 – G44). The majority of owners we visit just now are putting plans in place for marketing their home in the new year.

The owners that have come to the market recently have benefitted from competing against less properties. This has seen sales continue to be exceptional and well in excess of the home report value as the buyers active in the market just now are serious, with the hope to secure a property before Christmas."

Rightmove House Price Index

We take a look at what is happening nationally with the latest Rightmove House Price Index for November 2024. Here are the keys takeaways and headlines from the report:-

- Average new seller asking prices drop by 1.4% (-£5,366) this month to £366,592, a bigger fall than the usual, seasonal 0.8% drop seen at this time of year, likely due to pre- and post-Budget jitters

- However, despite the dampening effect of the Budget, market activity remains stronger than last year as Bank Rate falls:

- The number of sales being agreed is still 26% ahead of the quieter market at this time in 2023

- The number of new sellers deciding to move and coming to market is 6% ahead of the same period a year ago

- Rightmove’s real-time data shows some early signs of a post-Bank-Rate-cut uptick in buyer demand, though we still expect activity to tail off as usual towards Christmas

- Rightmove’s 2025 forecast is that average new seller asking prices will rise by 4%, our highest prediction since 2021, with lower mortgage rates releasing some of the pent-up housing demand and putting modest upwards pressure on prices

- The market remains price-sensitive, and seller competition is at its highest level for a decade. Those keen to sell will need to offer a well-presented and well-priced home to attract buyers who are spoilt for choice and still affordability-stretched

- Bank Rate cuts are now forecast to be slower-paced, so affordability may take longer to improve than previously expected

- In Scotland, average new seller asking prices drop by 2.4% this month to £193,179. Year on year asking prices are now 4% higher.

As always, if you have any questions relating to the property market or would like to discuss the current valuation of your home, please feel free to get in touch with your local Scottish Property Centre branch.

Looking to move in 2025? Get ahead and register for our ‘Heads Up Property Alerts’

Do you know we offer 3 types of valuation? This includes an instant on-line valuation, you can get started here.

Thinking of selling this winter? Download our free guide - A Guide to Selling in Winter - with expert advice and tips.